The fourth quarter of 2023 marked a turning point for global markets, with investor sentiment shifting from cautious to optimistic. This was driven by a combination of factors including positive economic data, strong ….

Pdf version of the article. Click here!

A Turnaround for Investors : Fourth Quarter of 2023 Review

The fourth quarter of 2023 marked a turning point for global markets, with investor sentiment shifting from cautious to optimistic. This was driven by a combination of factors, including positive economic data, strong corporate earnings, and a more dovish stance from central banks.

In the US, the economy grew at a moderate pace in the fourth quarter, and inflation moderated. The Federal Reserve has signaled that it may cut interest rates in 2024, which could further boost investor confidence.

In Europe, the economy also showed signs of resilience, despite the impact of the Omicron variant and the war in Ukraine. The European Central Bank (ECB) has held interest rates steady, but it may need to act if inflationary pressures persist.

Overall, the outlook for global markets in 2024 is positive. Investors should focus on identifying high-quality investments with attractive valuations.

From Uncertainty to Optimism

The fourth quarter of 2023 marked a significant turning point for global markets, as investor sentiment shifted from one of heightened uncertainty and volatility to one characterized by renewed optimism. This reversal was driven by a combination of factors, including positive economic data, strengthening corporate earnings, and a shift in monetary policy stance by central banks.

Economic Resilience and Market Rebound

The fourth quarter began with concerns surrounding rising long-term interest rates, which extended the late-summer decline in the S&P 500. However, as positive economic data emerged, coupled with better-than-feared corporate earnings, investor confidence began to improve. The softening of inflation and the Federal Reserve’s neutral policy stance further boosted sentiment, leading to a reversal of both stock prices and interest rates. This resulted in one of the most robust rallies in recent history for both equity and bond markets.

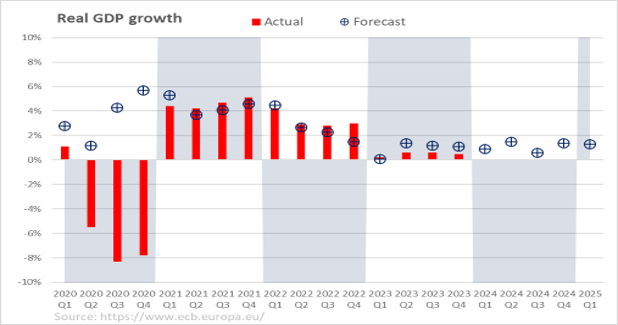

Resilient European Economy

While economic growth in Europe slowed in the fourth quarter, there were also signs of resilience. The Eurozone’s GDP forecast for Q4 2023 is 0.6%, compared to a decrease of 0.1% in Q3 2023. This slowdown was partly due to the impact of the Omicron variant and the ongoing war in Ukraine, which disrupted supply chains and boosted energy prices. However, inflation moderated, with core inflation edging down to 2.4%.

Cautious Central Bank Response

In response to elevated inflation, central banks in Europe, such as the European Central Bank (ECB), raised interest rates for the first time in years in July 2022. However, the ECB did so cautiously, indicating that it was committed to supporting the economic recovery while also addressing inflationary pressures. Since September 2023 ECB holds rates steady at 4.0% after 10 consecutive hikes.

Stock Market Rebound in Europe

Despite the economic challenges and geopolitical tensions, stock markets in Europe experienced a rebound in the fourth quarter. The Stoxx Europe 600 index, which tracks the performance of diversified country and industry allocation in Europe replicating some 90% of the underlying investable market, gained over 6% in the quarter. This rally was partly driven by a shift in investor sentiment towards riskier assets, as concerns about a recession eased.

US Market Concentration

Over the past year, the performance of the US stock market has been heavily influenced by a select group of 10 companies. These 10 companies, accounting for over 30% of the S&P 500, have driven most of the index’s gains. However, the valuations of the remaining 490 stocks in the index have not kept pace with the top 10 companies. This trend is also evident in mid- and small-cap, international, and emerging market companies.

Valuation Insights for Investors

In periods of market concentration, the value of portfolio management becomes increasingly important. Identifying high-quality investments at attractive valuations can help mitigate risks and enhance future returns.

Outlook for 2024

As we embark on 2024, the US economy has so far averted the feared recession and a re-acceleration of inflation. The Federal Reserve’s transition from a hawkish to a neutral stance and its more dovish tone for the year ahead provide a favorable environment for the market. If productivity gains continue to improve, corporate earnings expectations are likely to rise more broadly in 2024, even in the face of slower overall economic growth. This, coupled with increased earnings momentum, should justify the valuation expansion experienced by large US companies during the fourth quarter.

Potential Impact of Fed Rate Cuts in 2024

If the Fed and ECB decide to cut interest rates in 2024, it could have a positive impact on stock markets. This is because lower interest rates would make it less expensive for companies to borrow money, which could boost corporate profits. Additionally, lower interest rates would make stocks more attractive to investors compared to other asset classes.

The important question is of course when the first rate cut will materialize.

Peter Sjoeholm, CEO, CIO

DISCLAIMER These assessments are, as always, subject to the disclaimer provided below.

This material is published by Neox Capital Ltd, for information purposes only and should not be regarded as providing any specific advice. Recipients should make their own independent evaluation of this information and no action should be taken, solely relying on it. This material should not be reproduced or disclosed without our consent. It is not intended for distribution in any jurisdiction in which this would be prohibited. Whilst this information is believed to be reliable, it has not been independently verified by Neox Capital and Neox Capital makes no representation or warranty (express or implied) of any kind, as regards the accuracy or completeness of this information, nor does it accept any responsibility or liability for any loss or damage arising in any way from any use made of or reliance placed on, this information. Unless otherwise stated, any views, forecasts, or estimates are solely those of Neox Capital, as of this date and are subject to change without notice. Neox Capital is authorised and regulated by the MFSA. © Copyright 2024 Neox Capital. All rights reserved.