After three consecutive quarters of decline, corporate earnings are poised for a rebound, projecting modest growth in Q3 and a stronger expansion in Q4. This recovery trend is expected to continue into 2024, with calendar-year earnings growth projected to reach….

Pdf version of the article. Click here!

Corporate Earnings Recession Nearing its End:

Projections Suggest Modest Growth in Q3-23, Stronger Rebound in Q4-23 and Beyond

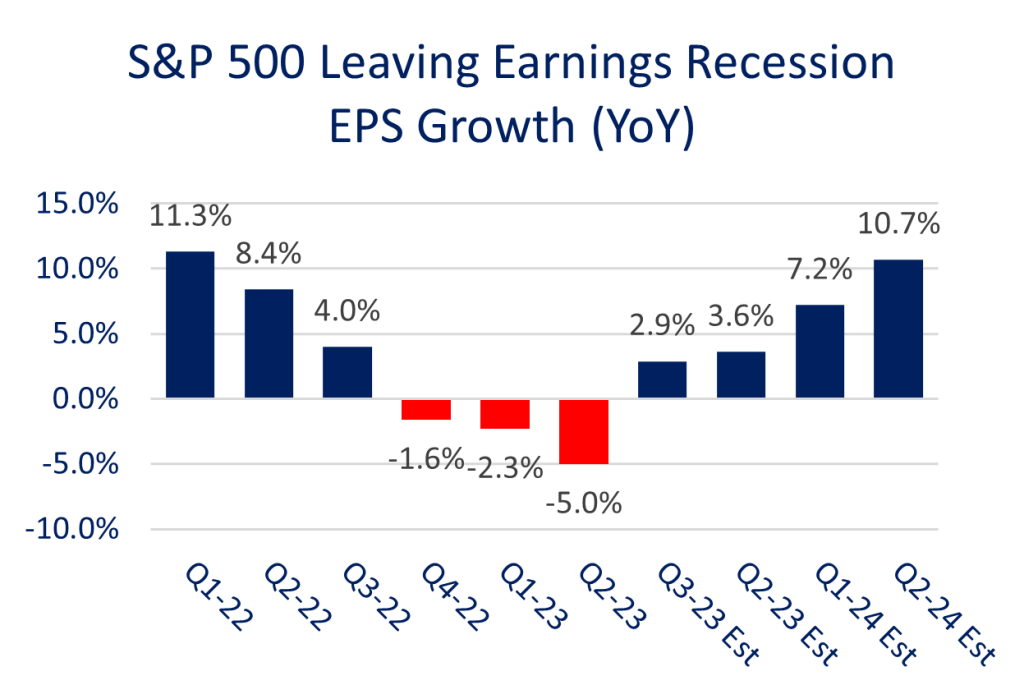

After three consecutive quarters of decline, corporate earnings are poised for a rebound, projecting modest growth in Q3 and a stronger expansion in Q4. This recovery trend is expected to continue into 2024, with calendar-year earnings growth projected to reach 10.7%. However, amidst tightened monetary policy and a slowing global economy, companies will need to demonstrate sustainable demand recovery, rather than relying solely on cost-cutting measures, to sustain this earnings growth trajectory.

Return graphs for different market indices

Modest Growth in Q3, Stronger Rebound in Q4 and Beyond

After three consecutive quarters of declining earnings, the corporate earnings recession may finally be coming to an end. FactSet’s aggregated analyst data expect average earnings for S&P 500 companies to have increased by a mere 2.9% in the third quarter from a year earlier, marking a significant improvement from the previous quarter’s 5% decline. This modest growth is expected to be followed by a more robust rebound in the quarters ahead, with analysts projecting an earnings expansion of 3.6 to 10.7%.

Looking ahead to 2024, researchers expect an even stronger rebound, with calendar-year earnings growth projected to reach 10.7%. This represents a substantial increase from the current year’s anemic forecast of 0.9% calendar-year growth.

Year-over-Year Comparisons: Favorable Base Effects and Sectoral Shifts

The recent “recession” quarters were significantly impacted by unfavorable comparisons to the robust postpandemic recovery period of late 2021 and early 2022. These base effects are expected to reverse going forward, potentially masking underlying earnings trends. Base effects have been particularly pronounced in the energy sector, which dominated earnings gains in 2022 with triple-digit profit growth driven by surging oil prices following Russia’s invasion of Ukraine. However, as crude prices retreated earlier this year, the sector’s outsized gains started to weigh on overall earnings. Recent oil price rebounds, familiar to consumers at the gas pump, suggest that the energy sector could once again provide a boost to earnings growth. Consumer spending, another key driver of economic activity, also exhibited a notable pattern. After a relatively subdued first half of the year, consumer spending picked up in the latter half of the summer, potentially signaling a resurgence in demand that could support earnings growth across various sectors.

Key Takeaways:

- The corporate earnings recession is expected to end in the third quarter of 2023.

- Modest earnings growth is projected in the third quarter, followed by a stronger rebound in the fourth quarter.

- Calendar-year earnings growth is expected to accelerate in 2024.

- We remain cautious, emphasizing the need for companies to demonstrate durable demand recovery.