Invest tech

Discover how Neox Capital’s proprietary investment technology drives smarter equity decisions

by combining data science with rigorous financial analysis to uncover market opportunities.

Approach

For us, an ordinary investment process is not enough, so we decided to go the extra mile and employ a flexible, innovative and intuitive approach to investing with a variety of factors, strategies and objectives.

Our core strategy focuses on identifying undervalued high quality companies. This is evident in our preference for long-only portfolios in publicly traded firms. The duration of our holdings is inclined towards medium to long-term, ensuring optimal capital appreciation and risk mitigation.

Our coverage encompasses some of worlds biggest markets, Europe and US, to capture a broad spectrum of investment prospects.

Company quality metrics

As a part of our process our goal is to identify company quality metrics. Looking for companies with higher quality metrics compared to their peers we examine attributes such as a positive margin of safety, consistent years of profitability, and impressive return on invested capital amongst others.

For companies that meet our quality criteria, we delve into fundamental data to find attractively priced companies. Some of the metrics giving us insight include positive fair value, profitability, funding and low risk of financial distress.

Nonetheless, it’s important to note that fairly valued companies may remain in that state or even undervalued for extended periods, not aligning with our criteria for attractive investments. To address this challenge, we incorporate component that seeks to identify companies with most robust market movement.

Our approach

Our approach is grounded in research, ensuring that our investment advice is both data-driven and research-backed. Research gives us the insight and continuous improvement of our investment models. Our team diligently analyzes all aspects of investment. Area of interest covers different quantitative and qualitative indicators and their impact to individual stocks, groups of peers and portfolios. We are exploring innovative methods to analyze market trends and develop sophisticated active portfolio management strategies. We are constantly striving to improve and provide best possible service to our clients.

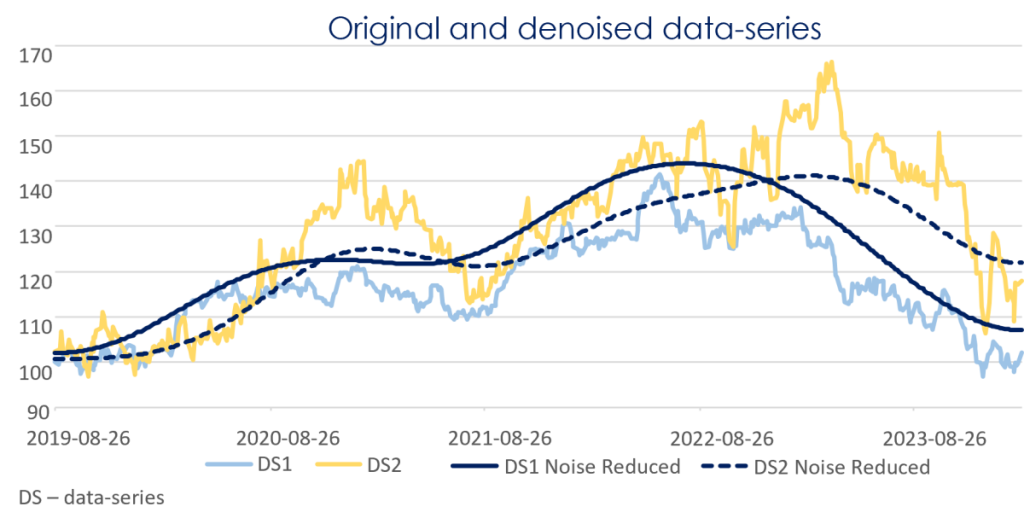

One of crucial parts of our research is understanding key information stored within data points. Given the ever-increasing volume of data, it is imperative that we carefully manage noise in data to avoid reaching erroneous conclusions that would lead to more unpredictable performance. As part of our research, we have developed tailored data pipelines to remove noise from data to enable better analysis. Those pipelines are used in our daily operations within Neox iQ system which monitors our live portfolios.

Noise everywhere around us

Noise in our opinion exists as two-fold problem.

Firstly, noise represents all random information added to base signal (in our case time series) in communication channel, resulting in false interpretation. Secondly, noise represents unwanted interference of other external sources, like hype, incorrect ideas and analyses.

Noise obscures the trend and shifts the focus away from the most essential. We are continuously developing our data pipelines to de-noise the data in order to gain useful insights into the relationships between data points.

The Neox IQ system

- In order to apply insights from our research to everyday portfolio analysis we have developed Neox iQ system. It encompasses a diverse array of digital tools using innovative strategies dedicated to refining and elevating the investment process. Employing power of data analytics, automation and more, we can provide our clients with an array of benefits. These include enhanced insights, streamlined portfolio management, and tailored investment guidance.

- Neox iQ is designed to process a comprehensive range of data, primarily focusing incorporating our research data. A total of 6000 companies in Europe and USA are monitored daily through the system. In essence, we’ve transformed the traditional role of researchers into a digital format, where advanced algorithms and data analysis drive our investment strategies.

- We are able to focus more on client’s needs by utilizing Neox iQ. It automates and streamlines daily analysis and portfolio activities. The client journey begins by defining specific criteria and characteristics in a portfolio through interactive process to create tailor-made portfolios. We then create a batch of similar portfolios based on agreed-upon strategy. Through iterative approach of mutually competing portfolios we can better optimize them to suit defined objectives. We select the best performing optimized portfolio as the model portfolio for the specific client portfolio. We then generate initial investment advice and deliver it to the client.

- After the initial advice is executed on the client account, we use Neox iQ to analyze every element of the live and model portfolios daily. Changes in portfolio parameters are monitored and the system decides whether to make changes in allocation. If allocation changes occur in our model portfolios, advice with recommended trades for live portfolios will be generated and delivered to the client.