Services

Neox Capital offers a suite of tailored investment services designed to support sophisticated

equity strategies, combining deep market expertise with disciplined risk management.

Benefits of working with us

Your Portfolio, Your Control

When you invest with us, you maintain full visibility and authority over your Neox portfolio. Your capital and holdings are securely held in your own custody account, hosted by your bank of choice. Your portfolio, your control. Period.

Continuous Monitoring

To keep your investments on track and aligned with your goals, we monitor your investments, assess performance, and calculate next steps in providing you with expert advice. Through the harmony of transparency, control and unparalleled guidance, we take great pride in putting you first. Always.

Equity Portfolios available to you

In the realm of equity portfolios, we have two distinct approaches: standard and customized. Standard equity portfolios are pre-packaged, exhibiting a well-defined strategy, while customized equity portfolios are meticulously tailored to any specific financial goals, risk tolerance, and preferences you might have.

Standard portfolios offer simplicity and convenience, providing broad market exposure. In contrast, customized portfolios prioritize precision, ensuring that our investment decisions align with your specific objectives.

As we explore these two approaches in more detail, you’ll gain insights into which one suits your investment journey best.

Standard vs Customised Equity Portfolios

Customized Portfolio

Standard equity portfolios are the bedrock of many investment strategies. They typically consist of active managed pre-structured collections of stocks, e.g. a region such as Europe, Europe & USA, or Nordics, a theme such as Health Care, following a predefined asset allocation model.

These portfolios aim to provide broad exposure to the equity markets, allowing investors to participate in the overall growth of the stock market. While they offer simplicity and convenience, they may not always align perfectly with an individual’s unique financial objectives and risk tolerance.

Customized Equity Portfolios: Tailored to your needs

Customized equity portfolios offer great flexibility and precision in investment decisions. They are personalized in nature, tailor-made to account for factors such as investment horizon, income requirements, ethical considerations, and much more.

We continuously align every element of the portfolio with individual financial objectives and preferences. Customization extends to asset allocation, stock selection, risk management, and regular reviews.

Flagship Equity Portfolios

Standard Equity Portfolios: A Familiar Approach

Powered by technology – Neox iQ Neox Capital Invest-tech process. If you don’t believe in a one-size-fits-all approach to investing, then . .

Powered by technology – Neox iQ Neox Capital Invest-tech process.

If you don’t believe in a one-size-fits-all approach to investing, then customised portfolio is your solution. While individuals, families, and institutions may have similarities, each is unique and requires a custom strategy to meet their requirements, values and needs. We dive deep to understand which stocks best reflect your ambition.

We Build the Investment Strategy, Together

Our straightforward, transparent approach to investing allows us to control risk more effectively, maintain flexibility, and manage costs. We synthesize complex analysis to find companies that are fair valued, of high quality and with a high movement indicator.

We apply a scientific research-driven, evidence-based method to select companies to include in the portfolio strategy and to ensure they are made in your best interest.

No reliance on subjective decisions

Reliance on data showing that certain risks are consistently rewarded in the long run.

Portfolio companies selected to efficiently capture rewards for accepting proven risks

Focus on structured framework for handling investments

Thematic Portfolio

Invest in big ideas. Thematic investing provides investors with opportunities to invest in big ideas and themes that might span specific . . .

Invest in big ideas.

Thematic investing provides investors with opportunities to invest in big ideas and themes that might span specific goals, sectors, or countries. For instance, thematic portfolios might be:

• Country specific e.g. UK Brexit

• Sector Specific e.g. Technology

• Theme specific e.g. Socially responsible investments

• Factor specific e.g. High dividend strategy

With portfolio themes, investors can harness their personal market views or ideas.

How does thematic investing work?

In some cases, thematic investors use themes to capitalize on anticipated changes, such as advancements in healthcare and technology. In others, investors wish to skew their investment towards high cash flow, or low volatility companies.

Regardless of the specifics, investing in themes generally works the same way. Thematic portfolios hold companies exposed and correlated to a trend or idea or exhibits certain sought-after properties.

ESG Portfolio

Align your investments with your values.Neox Capital offer ESG Portfolio Advice that allows you to align your investments more closely . . .

Align you investments with your values.

Neox Capital offer ESG Portfolio Advice that allows you to align your investments more closely with your own values.

Sustainable or ESG-investing can mean uniquely different to each and every one of us. Hence, investing in a standard sustainable portfolio might not at all adhere to your view of what’s important – therefore flexibility is paramount.

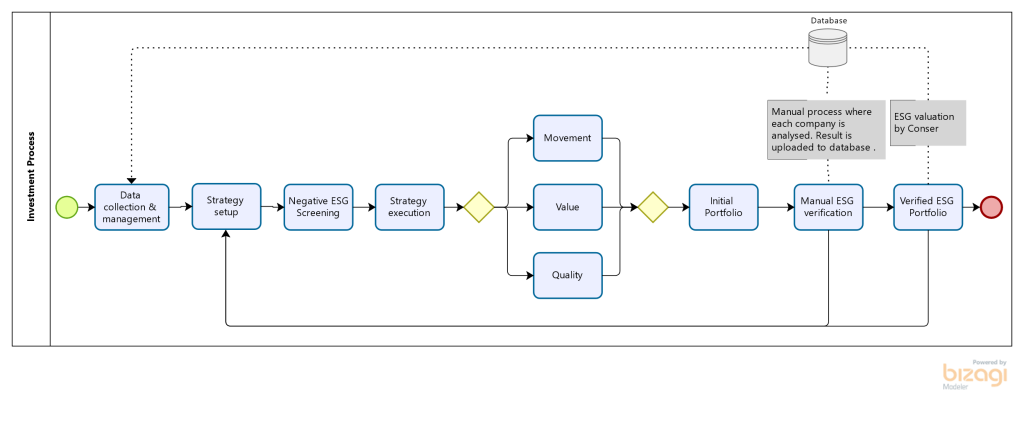

How we together select companies for your sustainable portfolio

Through Neox iQ, we optimise the portfolios for your sustainability standards. When building your portfolio, we start by removing companies that do not fit your own values through negative screening and removal of un-wanted sectors, followed by exclusion of individual companies defined by you to generate the coverage on which we base the portfolio allocation.

In the next step Neox iQ executes the strategy by combining companies that meet your criteria into an initial portfolio setup. A manual verification of each company selected for the portfolio is then implemented to assure maximal adherence to your ESG/Sustainable strategy.

The portfolio is monitored daily.

An additional third-party sustainability audit can be added periodically.

Products

Stock picking Advice

Neox run its stock screening tool every day, looking through 6000 listed companies. Fundamental as well as market data is analysed. The result of this extensive data crunching is an equity portfolio that we recommend to our clients. We can easily put in the clients own restrictions, thresholds, and preferences into the screening process resulting in tailormade advice.

Funds and Asset Managers

Neox’s advice is used as input into Funds and Asset Managers stock selection in Europe. Financial institutions may use Neox advice to power their products (white labeling). The stock selection is then adapted to fit each products preferred characteristics and goals.

Certificates

We advise on different certificates based on our equity portfolios. A certificate can follow a specific strategy, such as “High Dividend” or “Low Volatility” or be thematic in nature as in a “Renewable Energy” theme. Further, it could also be possible to reduce market risk by constructing a market neutral certificate. Designated certificates could be set up from 1-2m EUR depending on the strategy.

A certificate will be set up with a bank or on SPV as issuer. The certificate will have its own ISIN code and can be listed on exchange in Europe if needed.